Process costing system-determining unit costs

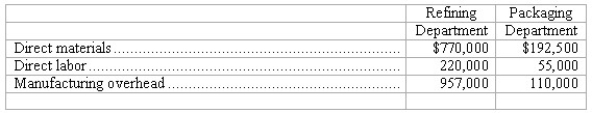

Houston Oil Company uses a process costing system with two departments: (a)a Refining Department and (b)a Packaging Department.During June,its first month of operations,the company manufactured and sold 650,000 gallons of motor oil,generating total revenue of $3,845,000.The company incurred the following manufacturing costs in June:  (a)How much was the unit cost per gallon of oil processed by the Refining Department in June?

(a)How much was the unit cost per gallon of oil processed by the Refining Department in June?

(b)If each case of oil contains four gallons,how much was the unit cost per case incurred by the Packaging Department in June?

(c)How much was the unit cost per case transferred to finished goods in June? (Round your final answer to one decimal place. )

(d)How much total gross profit did the company generate in June? (Do not round intermediate calculations)

Definitions:

Sole Supplier

A single source from which a company purchases goods or services, often leading to increased negotiation power for the supplier but potential risks for the buyer.

Cash Conversion Cycle

A metric that measures the time span between a company's outlay of capital for supplies and receiving payment from the sale of those goods or services.

Accounts Receivable

Money owed to a business by its clients or customers for goods or services provided on credit.

Inventory Conversion Period

The average time it takes for a company to turn its inventory into sales.

Q4: It would be _ for managers to

Q21: In making a decision,management will look thoroughly

Q30: Process costing with equivalent units and beginning

Q55: The basic approach of just-in-time inventory systems

Q64: At the current selling price of $170

Q69: A budget that can be easily adjusted

Q70: At the reduced selling price of $65

Q79: If beginning inventory in Work in Process

Q81: The accountant for Foster Institute,Inc. ,determined the

Q149: Compute the cash payments for operating expenses.<br>A)$146,000<br>B)$118,000<br>C)$162,000<br>D)$130,000