Allocating activity cost pools to products

Laughton Corporation makes two styles of cases for compact disks,the standard case and the deluxe case.The company has assigned $210,000 in monthly manufacturing overhead to three cost pools as follows: $90,000 to machining costs,$60,000 to production set-up costs,and $60,000 to inspection costs.

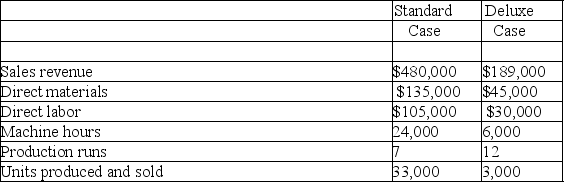

Additional monthly data are provided below:

The first and last unit in each production run is inspected for quality control purposes.Inspection costs are allocated to the products based on the number of inspections required.Machining costs are allocated to products using machine hours as an activity base.Set-up costs are allocated to products based on the number of production runs each product line requires.

The first and last unit in each production run is inspected for quality control purposes.Inspection costs are allocated to the products based on the number of inspections required.Machining costs are allocated to products using machine hours as an activity base.Set-up costs are allocated to products based on the number of production runs each product line requires.

(a)Allocate manufacturing overhead from the activity cost pools to each product line.

(b)Compare the total per-unit cost of manufacturing standard cases and deluxe cases.

(c)On a per-unit basis,which product appears to be more profitable?

Definitions:

Stock Dividend

A dividend payment made in the form of additional shares rather than a cash payout, increasing the number of shares owned.

Par Common Stock

Common stock issued with a nominal value expressed in the corporate charter, which represents the stock's legal capital per share.

Market Price

The prevailing market price at which you can buy or sell an asset or service.

Cumulative Preferred Stock

A type of preferred stock that entitles shareholders to receive dividends in arrears before common stockholders can be paid dividends.

Q1: What is the contribution margin ratio of

Q9: For the month of June,the number of

Q20: Sales of products with high contribution margins

Q21: Which of the following is not a

Q33: For the current year,Voque Company reported basic

Q42: When sales of one product contribute to

Q69: Which of the following is not commonly

Q70: The journal entry to record the transfer

Q91: A company with an operating income of

Q139: The "worksheet approach" to preparing a statement