Allocating activity cost pools to products

Laughton Corporation makes two styles of cases for compact disks,the standard case and the deluxe case.The company has assigned $210,000 in monthly manufacturing overhead to three cost pools as follows: $90,000 to machining costs,$60,000 to production set-up costs,and $60,000 to inspection costs.

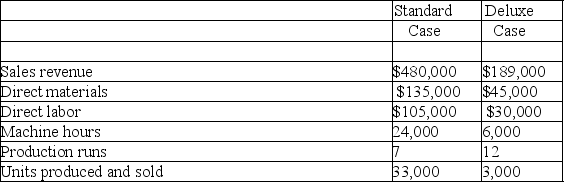

Additional monthly data are provided below:

The first and last unit in each production run is inspected for quality control purposes.Inspection costs are allocated to the products based on the number of inspections required.Machining costs are allocated to products using machine hours as an activity base.Set-up costs are allocated to products based on the number of production runs each product line requires.

The first and last unit in each production run is inspected for quality control purposes.Inspection costs are allocated to the products based on the number of inspections required.Machining costs are allocated to products using machine hours as an activity base.Set-up costs are allocated to products based on the number of production runs each product line requires.

(a)Allocate manufacturing overhead from the activity cost pools to each product line.

(b)Compare the total per-unit cost of manufacturing standard cases and deluxe cases.

(c)On a per-unit basis,which product appears to be more profitable?

Definitions:

Q23: Pool-Glow,Inc.has developed a new light for lighting

Q31: The following information is available for the

Q35: The SEC requires public companies to use

Q37: In a statement of cash flows,the term

Q51: The contribution margin ratio is computed as:<br>A)Sales

Q72: Seeking creative solutions to problems<br>Explain why it

Q74: Company MHF operates subsidiaries in two countries.One

Q84: Management accounting reports may provide sufficient means

Q116: Cash flows and accounting records<br>In a business

Q145: A corporation is a legal entity separate