Foreign Currency Transactions The Following Table Summarizes the Facts of Five Independent Cases

Foreign currency transactions

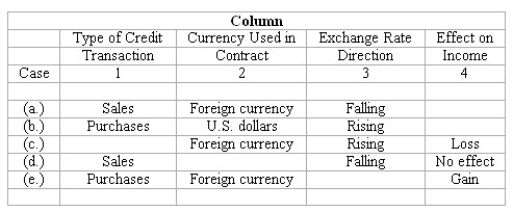

The following table summarizes the facts of five independent cases (labeled a through e)of American companies engaging in credit transactions with foreign corporations while the foreign exchange rate is fluctuating:  Instructions:

Instructions:

After evaluating the information about each case,fill the blank space that has been left in one of the four columns.

The content of each column and the word or words that you should enter in the blank spaces are described below:

Column 1 indicates the type of credit transaction in which the American company engaged with the foreign corporations.The answer entered in this column should be either "Sales" or "Purchases."

Column 2 indicates the currency in which the invoice price is stated.The answer may be either "U.S.dollars" or "Foreign currency."

Column 3 indicates the direction in which the foreign currency exchange rate has moved between the date of the credit transaction and the date of settlement.The answer in this column may be either "Rising" or "Falling."

Column 4 indicates the effect of the exchange rate fluctuation upon the income of the American company.The answers entered in this column are to be selected from the following: "Gain," "Loss," or "No effect."

Definitions:

Uncollectible Accounts

Accounts receivable that a company has determined it will not be able to collect due to customer default.

Direct Write-off

A method of accounting for bad debts where uncollectible accounts receivable are directly written off against income at the time they are deemed uncollectible.

Bad Debts Recovered

When an account receivable has been written off and is recovered, this account, which is in the Other Revenue category, is credited in the direct write-off method if the recovery is in a year following the write-off.

Allowance for Doubtful Accounts

A contra asset account that estimates the portion of receivables that may not be collectible, affecting a company’s net income and assets.

Q9: A quality cost report would be comprised

Q13: During the month of June,$352,150 of costs

Q29: Which company would most likely not use

Q55: An exchange rate represents the price of

Q78: A value chain is a linked set

Q80: What are the equivalent units for materials?<br>A)92,000

Q82: Process costing systems:<br>A)Are used when companies produce

Q115: Special sections in an income statement<br>What is

Q130: All of the following are financing activities

Q141: The rights of a common stockholder do