Indicate how each of the following events should be classified in a statement of cash flows for the current calendar year.Use the following code: O = operating activities,I = investing activities,and F = financing activities.

Assume use of the direct method.If the event does not involve a cash flow that should be included in the statement of cash flows,use an X.

________ (a)Paid an account payable for inventory purchased in a prior accounting period.

________ (b)On December 28,made a large credit sale;terms,2/10,n/30.

________ (c)Received a dividend from an investment in IBM common stock.

________ (d)Paid a dividend to stockholders.

________ (e)Paid the interest on a note payable to First Bank.

________ (f)Paid the principal amount due on the note payable to First Bank.

________ (g)Transferred cash from a checking account into a money market fund.

________ (h)Made an adjusting entry to record accrued wages payable at the end of the period.

________ (i)Recorded depreciation expense for the current year.

________ (j)Purchased plant assets for cash.

Answer: O

(a)Paid an account payable for inventory purchased in a prior accounting period.

X (b)On December 28,made a large credit sale;terms,2/10,n/30.

O (c)Received a dividend from an investment in IBM common stock.

F (d)Paid a dividend to stockholders.

O (e)Paid the interest on a note payable to First Bank.

F (f)Paid the principal amount due on the note payable to First Bank.

X (g)Transferred cash from a checking account into a money market fund.

X (h)Made an adjusting entry to record accrued wages payable at the end of the period.

X (i)Recorded depreciation expense for the current year.

I (j)Purchased plant assets for cash.

Difficulty: 1 Easy

Topic: Classification of Cash Flows

Learning Objecti: 13-02 Describe how cash transactions are classified in a statement of cash flows.

Bloom's: Remember

AACSB: Analytical Thinking

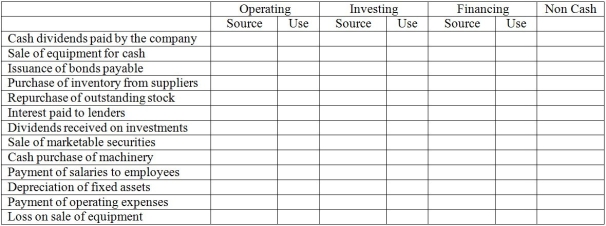

-Place an X in the column signifying whether the activity is an operating,investing,or a financing activity,and if it is a source or a use of funds or if it is a non-cash activity.

Definitions:

Current Assets

Assets that are expected to be converted into cash, sold, or consumed in the business within one year or within the business's operating cycle, whichever is longer.

Current Liabilities

Short-term financial obligations that a company owes and are due within one year.

Total Liabilities

The sum of all financial obligations or debts that a company owes to outside parties.

Acid-Test Ratio

A financial metric used to determine a company’s ability to pay off its short-term liabilities with its most liquid assets, excluding inventory.

Q20: A 2-for-1 stock split will:<br>A)Increase the total

Q39: What are the total manufacturing overhead costs

Q45: The unit cost per gallon of soup

Q45: A debit balance in the manufacturing overhead

Q54: Generally Accepted Accounting Principles<br>The accounting department of

Q71: The set of linked activities and resources

Q79: If beginning inventory in Work in Process

Q115: Stockholders of a corporation are personally liable

Q118: "Discontinued operations" is an example of an

Q194: When money is borrowed by issuing a