Indicate how each of the following events should be classified in a statement of cash flows for the current calendar year.Use the following code: O = operating activities,I = investing activities,and F = financing activities

Assume this company uses the direct method.If the event does not involve a cash flow that should be included in the statement of cash flows,use an X.

________ (a)Declared a dividend to be paid early next year.

________ (b)Recorded depreciation expense for the current year.

________ (c)At year-end,paid rent in advance for the next six months.

________ (d)Issued capital stock for cash;management plans to use this cash to invest in marketable securities.

________ (e)Sold a parcel of unused land at a loss.

________ (f)Collected principal amount due on a note receivable.

________ (g)Used the cash received in d,above,to purchase marketable securities.

________ (h)Collected interest due on note receivable described in f,above.

________ (i)Made an adjusting entry to accrue interest payable at year-end.

________ (j)Collected account receivable from a customer who made a large credit purchase in a prior period.

Answer: X

(a)Declared a dividend to be paid early next year.

X (b)Recorded depreciation expense for the current year.

O (c)At year-end,paid rent in advance for the next six months.

F (d)Issued capital stock for cash;management plans to use this cash to invest in marketable securities.

I (e)Sold a parcel of unused land at a loss.

I (f)Collected principal amount due on a note receivable.

I (g)Used the cash received in d,above,to purchase marketable securities.

O (h)Collected interest due on note receivable described in f,above.

X (i)Made an adjusting entry to accrue interest payable at year-end.

O (j)Collected account receivable from a customer who made a large credit purchase in a prior period.

Difficulty: 1 Easy

Topic: Cash Flows from Operating Activities;Cash Flows from Investing Activities

Learning Objecti: 13-03 Compute the major cash flows relating to operating activities. ;13-04 Compute the cash flows relating to investing and financing activities.

Bloom's: Remember

AACSB: Analytical Thinking

-Computation of cash flows

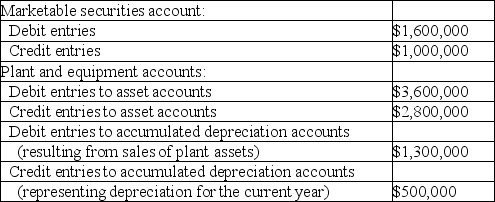

An analysis of changes in selected balance sheet accounts of Taurus Corporation shows the following for the current year:

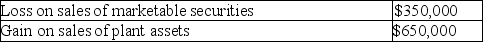

The income statement for the current year included the following items relating to the transactions summarized above:

The income statement for the current year included the following items relating to the transactions summarized above:

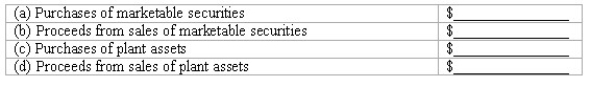

All payments and proceeds relating to these transactions were in cash.Using this information,compute the following cash flows for the current year:

All payments and proceeds relating to these transactions were in cash.Using this information,compute the following cash flows for the current year:

Definitions:

Eating Disorder

Mental disorders defined by abnormal eating habits that negatively affect a person's physical or mental health.

Dieting

The practice of eating food in a regulated and supervised fashion to decrease, maintain, or increase body weight.

Brain Serotonin

A neurotransmitter in the brain involved in regulating mood, emotion, and sleep, among other functions.

Sexually Abused

Refers to someone being subjected to unwanted sexual activity, often exercised through coercion or manipulation.

Q6: On April 16,2018,Rodriguez Corporation reacquired 12,000 shares

Q21: Dividends become a liability of a corporation:<br>A)On

Q23: Accounting terminology<br>Listed below are nine technical accounting

Q45: The unit cost per gallon of soup

Q54: Differences in accounting practices among countries reflect

Q83: Interest payable on a loan becomes a

Q87: The year-end balance in the Materials Inventory

Q128: The average issue price per share of

Q152: Net cash flow from operating activities for

Q157: For a company to survive in the