Indicate how each of the following events should be classified in a statement of cash flows for the current calendar year.Use the following code: O = operating activities,I = investing activities,and F = financing activities

Assume this company uses the direct method.If the event does not involve a cash flow that should be included in the statement of cash flows,use an X.

________ (a)Declared a dividend to be paid early next year.

________ (b)Recorded depreciation expense for the current year.

________ (c)At year-end,paid rent in advance for the next six months.

________ (d)Issued capital stock for cash;management plans to use this cash to invest in marketable securities.

________ (e)Sold a parcel of unused land at a loss.

________ (f)Collected principal amount due on a note receivable.

________ (g)Used the cash received in d,above,to purchase marketable securities.

________ (h)Collected interest due on note receivable described in f,above.

________ (i)Made an adjusting entry to accrue interest payable at year-end.

________ (j)Collected account receivable from a customer who made a large credit purchase in a prior period.

Answer: X

(a)Declared a dividend to be paid early next year.

X (b)Recorded depreciation expense for the current year.

O (c)At year-end,paid rent in advance for the next six months.

F (d)Issued capital stock for cash;management plans to use this cash to invest in marketable securities.

I (e)Sold a parcel of unused land at a loss.

I (f)Collected principal amount due on a note receivable.

I (g)Used the cash received in d,above,to purchase marketable securities.

O (h)Collected interest due on note receivable described in f,above.

X (i)Made an adjusting entry to accrue interest payable at year-end.

O (j)Collected account receivable from a customer who made a large credit purchase in a prior period.

Difficulty: 1 Easy

Topic: Cash Flows from Operating Activities;Cash Flows from Investing Activities

Learning Objecti: 13-03 Compute the major cash flows relating to operating activities. ;13-04 Compute the cash flows relating to investing and financing activities.

Bloom's: Remember

AACSB: Analytical Thinking

-Comparison of cash flows and accrual basis

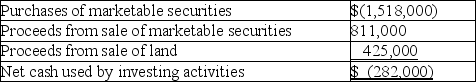

Underhill Corporation's statement of cash flows for 2018 shows the following information regarding investing activities:

Underhill Corporation's income statement for 2018 includes the following items:

Underhill Corporation's income statement for 2018 includes the following items:

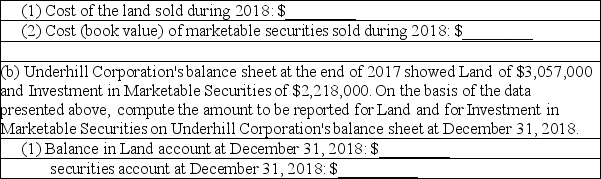

(a)All payments and proceeds relating to these transactions were in cash.Using this information,compute the following:

(a)All payments and proceeds relating to these transactions were in cash.Using this information,compute the following:

Definitions:

Q1: The Foreign Corrupt Practices Act (FCPA)affects all

Q6: On April 16,2018,Rodriguez Corporation reacquired 12,000 shares

Q16: The cost of finished goods manufactured in

Q26: Listed below are several terms and statements

Q56: When a job is completed:<br>A)Cost of goods

Q85: Manufacturing overhead is not:<br>A)A product cost.<br>B)An indirect

Q97: Depreciation on a manufacturing facility is considered

Q110: Early in 2018,Larsen Corporation purchased marketable securities

Q144: When bonds are issued at a discount,the

Q188: Deferred taxes are classified as:<br>A)Only a liability.<br>B)Only