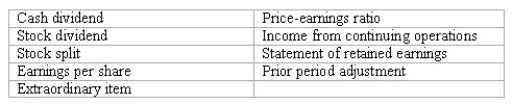

Accounting terminology

Listed below are nine technical accounting terms introduced in this chapter:  Each of the following statements may (or may not)describe one of these technical terms.In the space provided beside each statement,indicate the accounting term described,or answer "None" if the statement does not correctly describe any of the terms.

Each of the following statements may (or may not)describe one of these technical terms.In the space provided beside each statement,indicate the accounting term described,or answer "None" if the statement does not correctly describe any of the terms.

________ (a)A financial statement showing the revenue,expenses,and net earnings of a corporation during the current accounting period.

________ (b)A distribution of cash to stockholders.

________ (c)A distribution to stockholders of additional shares of stock,accompanied by a proportionate reduction in the par value per share.

________ (d)The market price of a share of preferred stock,divided by the net income of the corporation.

________ (e)A correction in the amount of net income reported in an earlier accounting period.

________ (f)An event that is material in dollar amount,unusual in nature,and not expected to recur in the foreseeable future.

________ (g)A subtotal sometimes included in an income statement to assist investors in forecasting the income of future accounting periods.

Definitions:

Coconuts

Often used in economic models and examples, referring to a simplistic commodity to illustrate principles of trade, investment, or resource allocation.

Equilibrium

A condition or state in which economic forces such as supply and demand are balanced, resulting in a stable market.

Coconuts

A large tropical fruit with a hard shell, edible white flesh, and clear liquid, often used in food and drink preparations.

Tax Imposed

An obligatory financial charge or other type of levy imposed upon a taxpayer by a governmental organization in order to fund government spending and various public expenditures.

Q12: The operating activities section of the cash

Q39: What are the total manufacturing overhead costs

Q46: Fully amortizing installment note payable (mortgage)<br>On October

Q81: Using different accounting methods on financial statements

Q129: Which of the following assets is not

Q133: The systematic write-off of intangible assets to

Q142: Land is purchased for $456,000.Additional costs include

Q146: The cash proceeds received by Korman Corporation

Q147: A bond with a $100,000 face value

Q164: If a long-term debt is to be