Determining book value per share

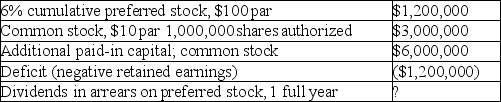

Shown below is information relating to the stockholders' equity of Churchill,Inc.:

From the above information,compute the following:

From the above information,compute the following:

(a)Number of shares of preferred stock issued and outstanding

(b)Average issue price per share of common stock

(c)Total paid-in capital

(d)Total stockholders' equity

(e)Book value per share of common stock

Definitions:

Return On Total Assets

A financial metric that measures a company's earnings before interest and taxes (EBIT) relative to its total asset value.

Net Profit Margin Percentage

A financial metric that shows what percentage of a company's revenues is left over after all expenses have been deducted, indicating profitability.

Return On Equity

A financial ratio indicating the profitability of a firm in relation to shareholders' equity, showing how effectively a company uses investors' funds to generate profit.

Year 2

Typically refers to the second year of a given time frame, period of analysis, or the second year of operation or study.

Q10: Wanda Company sold an asset for $10,000

Q15: The term paid-in capital means:<br>A)All assets other

Q18: Which of the following is not true

Q19: Assuming that Anderson uses the FIFO cost

Q32: The par value of the common stock

Q55: During the current year,Atkins,Inc.sold a parcel of

Q55: Bonds issued at par - basic concepts<br>On

Q71: Which of the following is not a

Q91: Which of the following would not be

Q175: The Social Security tax paid by an