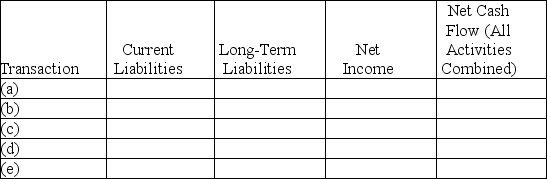

Effects of transactions upon financial measurements

Five events relating to liabilities are described below:

(a)Recorded a bi-weekly payroll,including the issuance of paychecks to employees.Amounts withheld from employees' pay and payroll taxes will be forwarded to appropriate agencies in the near future.(Ignore post-retirement costs. )

(b)Made a monthly payment on a 12-month installment note payable,including interest and a partial repayment of the principal amount.

(c)Shortly before the maturity date of a six-month bank loan,made arrangements with the bank to refinance the loan on a long-term basis.

(d)Made an adjusting entry to record accrued interest payable on a 2-year bank loan.(Interest is paid quarterly. )

(e)Made a year-end adjusting entry to amortize a portion of the discount on long-term bonds payable.

Indicate the immediate effects of each transaction or adjusting entry upon the financial measurements in the five column headings listed below.Use the code letters,I for increase,D for decrease,and NE for no effect.

Definitions:

Community Service

Voluntary work intended to help people in a particular area, often mandated as part of a punishment for a crime but also pursued for charitable or civic reasons.

Criminal Sanction

Punishments or penalties imposed by law for violating criminal statutes, including fines, imprisonment, or other corrective measures.

Capital Punishment

The legally authorized killing of someone as punishment for a crime, typically for the most serious offenses.

Indigenous Man

Refers to a male individual who is native to a particular region or country, belonging to the first inhabitants of the area.

Q10: Wanda Company sold an asset for $10,000

Q21: Dividends become a liability of a corporation:<br>A)On

Q51: Worker's compensation premiums are deducted from each

Q57: The ownership of common stock in a

Q59: When prices are increasing,which inventory method will

Q87: When comparing the units-of-output method of depreciation

Q111: When interest rates rise,the price of a

Q113: A company failed to make an adjusting

Q142: Silver Company received a two-month,6% note for

Q145: If a 15%,two-month note receivable is acquired