Fully amortizing installment note payable

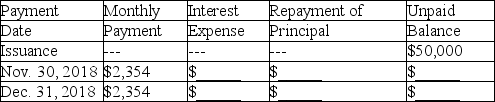

On October 31,2018 Ronald signed a 2-year installment note in the amount of $50,000 in conjunction with the purchase of equipment.This note is payable in equal monthly installments of $2,354,which include interest computed at an annual rate of 12%.The first monthly payment is made on November 30,2018.This note is fully amortizing over 24 months.

Complete the amortization table for the first two payments by entering the correct dollar amounts in the blank spaces provided.In addition,answer the questions that follow.

(a)With respect to this note,Ronald's 2018 income statement includes interest expense of $________,and Ronald's balance sheet at December 31,2018,includes a total liability for this note payable of ________.(Do not separate into current and long-term portions. )

(a)With respect to this note,Ronald's 2018 income statement includes interest expense of $________,and Ronald's balance sheet at December 31,2018,includes a total liability for this note payable of ________.(Do not separate into current and long-term portions. )

(b)The aggregate monthly cash payments Ronald will make over the 2-year life of the note payable amount to $________.

(c)Over the 2-year life of the note,the amount Ronald will pay for interest amounts to $________.

Definitions:

Poverty Line

A threshold set by governments to define the minimum income level necessary to afford basic necessities, delineating who is considered to be in poverty.

Political Conservatives

Individuals or groups who advocate for maintaining traditional institutions, values, and practices, often emphasizing limited government, personal responsibility, and free-market economy.

Welfare State

A government system that provides social and economic support to its citizens, such as healthcare, education, and social security.

Political Liberals

Individuals or groups advocating for progressive reforms, emphasizing personal freedoms, and supporting policies for social and economic equality.

Q7: The amortization of a bond premium:<br>A)Decreases the

Q18: Which of the following items would not

Q41: Which of the following best describes the

Q43: When bonds are sold by one investor

Q54: What is total paid-in capital?<br>A)$2,292,000<br>B)$1,800,000<br>C)$2,400,000<br>D)$2,340,000

Q72: The amount of FICA tax and Medicare

Q76: Which of the following activities affects net

Q123: On April 1,Year 1,the journal entry to

Q132: A stock dividend provides a stockholder with

Q144: An oil reserve is depreciated because of