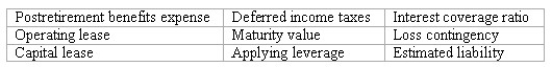

Accounting terminology

Listed below are nine technical accounting terms introduced in this chapter:  Each of the following statements may (or may not)describe one of these technical terms.In the space provided beside each statement,indicate the accounting term described,or answer "None" if the statement does not correctly describe any of the terms.

Each of the following statements may (or may not)describe one of these technical terms.In the space provided beside each statement,indicate the accounting term described,or answer "None" if the statement does not correctly describe any of the terms.

________ (a)Operating income divided by annual interest expense

________ (b)The amount paid during the current period to retired employees.

________ (c)A lease agreement that is viewed as equivalent to the lessee purchasing the leased asset.

________ (d)Using borrowed money to finance business operations.

________ (e)The risk of a loss occurring in a future period.

________ (f)A permanent reduction in the amount of income taxes owed which results from the tax deductions for depreciation.

________ (g)The amount that must be paid to settle a liability at the date it becomes due.

Definitions:

Q19: When doing a bank reconciliation,an NSF check

Q28: It would be reasonable to assume that:<br>A)Basic

Q36: Internal control over cash transactions<br>Listed below are

Q50: Loss contingencies should be recorded in the

Q62: Write-off of uncollectible account receivable<br>On January 10,Winston,Inc.'s

Q70: Inventory flow assumptions<br>Arrow,Inc.uses a perpetual inventory system.On

Q96: Bonds,with the same face value,issued at a

Q130: Which of the following represents the largest

Q135: The write-down of inventory:<br>A)Only affects the balance

Q162: Employees' annual "take-home-pay," totals approximately:<br>A)$642.800.<br>B)$760,000.<br>C)$681,200.<br>D)$658,800.