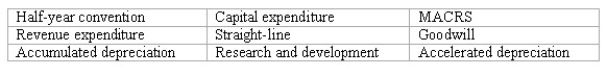

Accounting terminology

Listed below are nine technical accounting terms introduced in this chapter:  Each of the following statements may (or may not)describe one of these technical terms.In the space provided below each statement,indicate the accounting term described,or answer "None" if the statement does not correctly describe any of the terms.

Each of the following statements may (or may not)describe one of these technical terms.In the space provided below each statement,indicate the accounting term described,or answer "None" if the statement does not correctly describe any of the terms.

________ (a. )An expenditure that will benefit only the current accounting period.

________ b. )The accelerated depreciation system used in federal income tax returns for depreciable assets purchased after 1986.

________ c. )A policy that fractional-period depreciation on assets acquired or sold during the period should be computed to the nearest month.

________ d. )An intangible asset representing the present value of future earnings in excess of normal return on net identifiable assets.

________ e. )Expenditures that could lead to the introduction of new products,but which,according to the FASB,should be viewed as an expense when incurred.

________ f. )Depreciation methods that take less depreciation in the early years of an asset's useful life,and more depreciation in the later years.

________ g. )An account showing the portion of the cost of a plant asset that has been written off to date as depreciation expense.

Definitions:

Differentiating Self

The process of developing a strong sense of self-independence while maintaining close relationships, often discussed in psychology and personal development.

Social Exchange Theory

A concept in sociology that suggests human relationships are formed by a subjective cost-benefit analysis and the comparison of alternatives.

Relationship Failure

The breakdown or ending of a relationship due to various reasons, such as lack of communication, trust issues, or incompatible differences.

Marriage Theory

A set of ideas or principles that explain various aspects of marital relationships, including dynamics, functioning, and outcomes.

Q2: Payroll-related expenses<br>Shown below is a summary of

Q6: In a periodic inventory system,cost of goods

Q35: The account Discount on Bonds Payable actually

Q37: A customer purchased merchandise for $400,which cost

Q44: Estimated liabilities,contingencies,and commitments are usually reported in

Q48: The book value of an asset is

Q70: If an accelerated depreciation method is used

Q117: What is the gross profit?<br>A)$96,800<br>B)$133,600<br>C)$132,200<br>D)$230,400

Q170: Payments of pensions and other benefits to

Q206: As of December 31,2018,Chippewa Company has $26,440