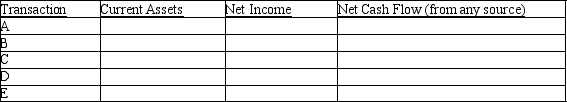

Financial assets-effects of transactions

Five events involving financial assets are described below:

(a. )Sold merchandise on account.

(b. )Sold available for sale marketable securities at a gain.Cash proceeds from the sale were equal to the current market value of the securities reflected in the last balance sheet.

(c. )Collected an account receivable.

(d. )Adjusted the allowance for doubtful accounts to reflect the portion of accounts receivable estimated to be uncollectible at year-end.

(e. )Made the fair value accounting adjustment reducing the balance in the available for sale marketable securities account to reflect a decrease in the market value of securities owned.

Indicate the effects of each independent transaction or adjusting entry upon the financial measurements shown in the column headings below.Use the code letters,I for increase,D for decrease,and NE for no effect.

Definitions:

Direct Costs

Expenses that can be directly attributed to the production of specific goods or services, such as raw materials and labor.

Job Cost Sheet

A record or document used in job order costing that summaries the costs associated with a particular job, including materials, labor, and overhead.

Job Order Costing

An accounting system used to calculate the cost of producing specific products or jobs, which may vary in materials, labor, and overhead.

Producing a Job

An approach to manufacturing where goods are produced based on specific customer orders, often involving customized products.

Q14: Using gross profit rates<br>Explain how the gross

Q32: For the last several years Conway Corporation

Q55: Bonds issued at par - basic concepts<br>On

Q56: In a periodic inventory system,the Cost of

Q60: A revenue expenditure is deducted from revenues

Q60: Which of the following account titles would

Q83: An annual report:<br>A)Must be audited by the

Q90: A gain is recognized on the disposal

Q112: This transaction involves:<br>A)Galloway's collection of $20,000 on

Q121: Closing entries do not affect the cash