Uncollectible accounts-two methods

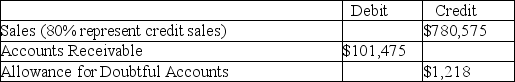

At the end of the year the unadjusted trial balance of Angel Provisions included the following accounts:

(a. )If Angel uses the balance sheet approach to estimate uncollectible accounts expense,and aging the accounts receivable indicates the estimated uncollectible portion to be $6,075,what will the uncollectible accounts expense for the year be?

(a. )If Angel uses the balance sheet approach to estimate uncollectible accounts expense,and aging the accounts receivable indicates the estimated uncollectible portion to be $6,075,what will the uncollectible accounts expense for the year be?

(b. )If the income statement approach to estimating uncollectible accounts expense is followed,and uncollectible accounts expense is estimated to be 1% of net credit sales,what is the amount of uncollectible accounts expense for the year?

Definitions:

Credit Side

The right side of an accounting ledger where credits are recorded, typically increasing liabilities and equity or decreasing assets.

Expenses

The money spent or costs incurred in an entity's efforts to generate revenue, representing the cost of doing business.

Withdrawals

Funds taken out from a business by its owner(s) for personal use.

Credit

An accounting entry that either increases a liability or equity account, or decreases an asset or expense account.

Q5: After closing the accounts,Retained Earnings at December

Q23: Depreciation and disposal-a comprehensive problem<br>Domino,Inc uses straight-line

Q43: Entries made in the general journal after

Q44: In a periodic inventory system,understating the amount

Q55: With available for-sale securities,unrealized holding gains and

Q59: The entry to close the Fees Earned

Q63: The Income Summary account has debits of

Q109: Gains (or losses)on sales of marketable securities,as

Q129: Every business transaction is recorded by a

Q139: Which of the following methods of measuring