Subsidiary Ledgers Listed Below Are Several Merchandising Transactions of Siegel's Garden Center,a

Subsidiary ledgers

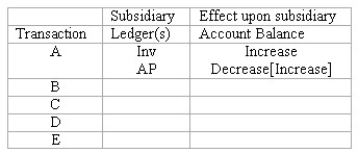

Listed below are several merchandising transactions of Siegel's Garden Center,a garden supply store.

(a)Purchased merchandise from Bayview Wholesale on account.

(b)Sold merchandise for cash.

(c)Sold merchandise on account to Dom's Landscaping Co.

(d)Paid the account payable to Bayview Wholesale.

(e)Collected the account receivable from Dom's Landscaping Co.

Among the accounting records maintained by Siegel's are subsidiary ledgers for inventory,accounts receivable,and accounts payable.

For each of the five transactions,you are to indicate any subsidiary ledger (or ledgers)to which the transaction would be posted.Use the code:

Inv = Inventory subsidiary ledger

AR = Accounts receivable subsidiary ledger

AP = Accounts payable subsidiary ledger

Also indicate whether each posting causes the balance in the subsidiary ledger account to increase or decrease.Organize your answer in tabular form as illustrated below.The answer for transaction a is provided as an example.

Definitions:

Fixed Expenses

Costs that do not vary with the level of production or sales over a short period, such as rent, salaries, and insurance.

Break-Even

The point at which total costs and total revenues are equal, meaning there is no net loss or gain.

Absorption Costing

A costing method that includes all manufacturing costs—direct materials, direct labor, and both variable and fixed manufacturing overhead—in the cost of a product.

Variable Manufacturing Costs

Costs that fluctuate directly with the level of production output, such as the costs of raw materials and direct labor.

Q2: Accounting terminology<br>Listed below are nine technical accounting

Q40: Which of the following is correct if

Q58: One of the purposes of adjusting entries

Q80: The purpose of the after-closing trial balance

Q97: When the maker of a note defaults:<br>A)An

Q117: In a periodic system,the only account with

Q124: If Cash at December 31,2018,is $26,000,total owners'

Q128: Every adjusting entry involves the recognition of

Q155: Stanley,Inc.'s 2018 income statement reported net sales

Q169: The Kansas Company makes credit sales to