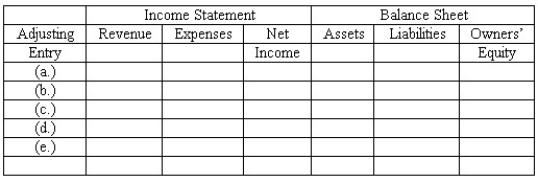

Adjusting entries-effect on elements of financial statements

Whoop-It-Up,Inc.prepares monthly financial statements.On March 31,the company's accountant made adjusting entries to record:

(a)Depreciation for the month of March.

(b)Amount owed to Whoop-It-Up,Inc for March from the concessionaire operating a juice bar in the facility.The amount due will be remitted to Whoop-It-Up,Inc during the first week in April.

(c)Cost of supplies used in March.(When purchased,the cost of supplies is debited to an asset account. )

(d)Earning of a portion of annual membership fees which had been collected in advance.(When customers purchase annual memberships,an Unearned Revenue account is credited. )

(e)Accrued interest for March owed on a bank loan obtained March 1.No interest expense has yet been recorded.

Indicate the effect of each of these adjusting entries on the major elements of the company's financial statements-that is,on revenue,expenses,net income,assets,liabilities,and owner's equity.Organize your answer in tabular form,using the column headings shown below and the symbols + for increase,- for decrease,and NE for no effect.

Definitions:

User Program

A software application or set of instructions created by a user or developer to perform specific tasks on a computer or device.

XIC

Stands for "Examine if Closed", a PLC programming instruction used to check if a specified contact or virtual contact is in the closed state.

XIO

An instruction used in ladder logic programming that represents "Examine if Open," checking if a specific condition is not met or a device is inactive.

Contact Instructions

Fundamental instructions in PLC programming that mimic electrical contacts, used to control the flow of logic based on conditions being true or false.

Q12: If Capital Stock is $260,000,what is the

Q31: What are total assets of Quality Galleries

Q42: All of the following statements are true

Q42: Balance sheet method-journal entries<br>The general ledger controlling

Q46: The concept of materiality:<br>A)Treats as material only

Q58: Which of the following is not a

Q82: Journal entries for merchandising transactions<br>Shown below is

Q93: Interim financial statements:<br>A)Cover a period less than

Q102: Master Equipment has a $17,400 liability to

Q123: Cardinal Company's bank statement showed a balance