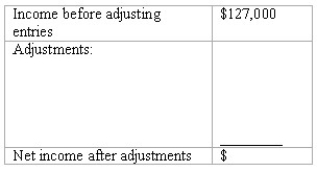

End-of-period adjustments-effect on net income

Before making any year-end adjusting entries,the revenues of Hot Jazz Studio exceeded expenses by $127,000.However,the following adjustments are necessary:

(a. )Prepaid rent consumed,$1,500.

(b. )Services rendered to clients but not yet billed,$20,000.

(c. )Interest accrued on notes payable,$1,100.

(d. )Depreciation,$4,800.

(e. )Accrued wages payable,$3,900.

(f. )Fees collected in advance which have now been earned,$7,100.

Complete the schedule to determine the net income of Hot Jazz Studio after these adjustments have been recorded.Show the effect of each adjustment in the space provided.Compute net income after adjustments and place answer in space provided.

Definitions:

Matching Principle

An accounting principle that requires companies to report expenses at the same time as the revenues they are related to are earned.

Matching Expenses

An accounting principle that matches expenses with the revenues they generate within the same accounting period.

Revenue Recognition Principle

An accounting principle that dictates how and when revenue is accounted for and reported, emphasizing that income is recognized when earned, regardless of when cash is received.

Reporting Revenue

Reporting revenue involves the recognition and recording of income generated from the sales of goods or services in the financial statements of a corporation.

Q4: When a sole proprietorship incorporates,the assets of

Q14: Financial statements<br>Briefly describe the balance sheet,the income

Q26: Real accounts can only be closed at

Q35: Which of the following is a characteristic

Q37: Financial and management accounting information<br>Explain one way

Q84: Which of the following has the least

Q100: The purchase of equipment on credit is

Q112: This transaction involves:<br>A)Galloway's collection of $20,000 on

Q148: The statement "This business produced net income

Q197: Bank reconciliation<br>At March 31,the balance of the