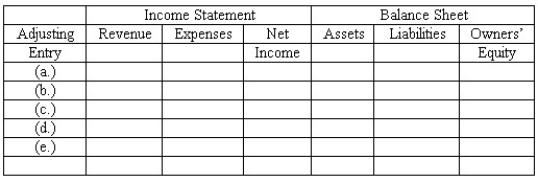

Adjusting entries-effect on elements of financial statements

Whoop-It-Up,Inc.prepares monthly financial statements.On March 31,the company's accountant made adjusting entries to record:

(a)Depreciation for the month of March.

(b)Amount owed to Whoop-It-Up,Inc for March from the concessionaire operating a juice bar in the facility.The amount due will be remitted to Whoop-It-Up,Inc during the first week in April.

(c)Cost of supplies used in March.(When purchased,the cost of supplies is debited to an asset account. )

(d)Earning of a portion of annual membership fees which had been collected in advance.(When customers purchase annual memberships,an Unearned Revenue account is credited. )

(e)Accrued interest for March owed on a bank loan obtained March 1.No interest expense has yet been recorded.

Indicate the effect of each of these adjusting entries on the major elements of the company's financial statements-that is,on revenue,expenses,net income,assets,liabilities,and owner's equity.Organize your answer in tabular form,using the column headings shown below and the symbols + for increase,- for decrease,and NE for no effect.

Definitions:

Necessity

A good or service that is considered essential for survival, such as food, shelter, and healthcare.

Income Elasticity

A measure of how much the demand for a good or service changes in response to a change in consumers' income.

Quantity Demanded

The aggregate quantity of a product or service that buyers are ready and capable of buying at a specific price point.

Changes

Variations or modifications that occur in any system, context, or entity over time.

Q17: The operating cycle of a merchandiser is

Q25: Jensen's entry to record the collection of

Q46: The present value of an annuity is

Q57: One purpose of generally accepted accounting principles

Q70: Which of the following accounts normally has

Q75: According to the Sarbanes-Oxley Act,CEOs and CFOs

Q108: In a trial balance prepared at December

Q124: Depreciation expense is:<br>A)Only an estimate.<br>B)An exact calculation

Q129: Every business transaction is recorded by a

Q144: Effects of a series of transactions on