Recording transactions in T accounts;trial balance

On May 15,George Manny began a new business,called Sounds,Inc. ,a recording studio to be rented out to artists on an hourly or daily basis.The following six transactions were completed by the business during May:

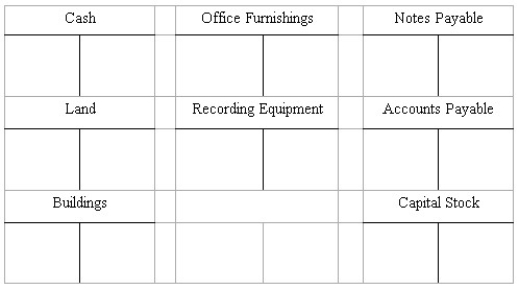

(a. )Issued to Manny 5,000 shares of capital stock in exchange for his investment of $200,000 cash.

(b. )Purchased land and a building for $410,000,paying $100,000 cash and signing a note payable for the balance.The land was considered to be worth $310,000 and the building $100,000.

(c. )Installed special insulation and soundproofing throughout most of the building at a cost of $120,000.Paid $32,000 cash and agreed to pay the balance in 60 days.Manny considers these items to be additional costs of the building.

(d. )Purchased office furnishings costing $18,000 and recording equipment costing $88,400 from Music Supplies.Sounds paid $28,000 cash with the balance due in 30 days.

(e. )Borrowed $180,000 from a bank by signing a note payable.

(f. )Paid the full amount of the liability to Music Supplies arising from the purchases in D above.

Instructions

(A. )Record the above transactions directly in the T accounts below.Identify each entry in a T account with the letter shown for the transaction.This exercise does not call for the use of a journal.  (B. )Prepare a trial balance at May 31 by completing the form provided.

(B. )Prepare a trial balance at May 31 by completing the form provided.

SOUNDS,INC.

Trial Balance

May 31,20__

Debit Credit

Definitions:

Rotary Circular Files

Tools used in dentistry and endodontics for enlarging and shaping canals during root canal treatments.

Patient Records

Documents that contain detailed and comprehensive information regarding a patient's health history, treatments, and care.

Plastic Inserts

Components made of plastic designed to fit into another object to serve as a reinforcement, filler, or adapter.

Heavy Cardboard

A thick and sturdy paper-based material used for making durable items like packaging boxes.

Q20: After closing the accounts,Retained Earnings at December

Q31: If Cash at December 31,2018,is $86,000,Capital Stock

Q46: A strong statement of financial position shows:<br>A)Large

Q53: In a trial balance prepared for Ceramic

Q70: 200 Noble's operating income was:<br>A)$1,610.<br>B)$675.<br>C)$935.<br>D)$115.

Q71: If sales are $540,000,expenses are $440,000 and

Q74: The Cash account is usually affected by

Q81: Current assets are those assets that are

Q86: Hicksville's Department Store uses a perpetual inventory

Q145: The purpose of accrual accounting is to