Recording transactions directly in T accounts;trial balance

On July 20,Mollie Rose began a new business called MR Printing,which provides typing,duplicating,and printing services.The following six transactions were completed by the business during July.

(a. )Issued to Rose 1,000 shares of capital stock in exchange for her investment of $200,000 cash.

(b. )Purchased land and a small building for $450,000,paying $165,000 cash and signing a note payable for the balance.The land was considered to be worth $240,000 and the building $210,000.

(c. )Purchased office equipment for $30,000 from Quality Interiors,Inc.Paid $17,000 cash and agreed to pay the balance within 60 days.

(d. )Purchased a motorcycle on credit for $3,400 to be used for making deliveries to customers.Mollie agreed to make payment to Spokes,Inc.within 10 days.

(e. )Paid in full the account payable to Spokes,Inc.

(f. )Borrowed $30,000 from a bank and signed a note payable due in six months.

Instructions

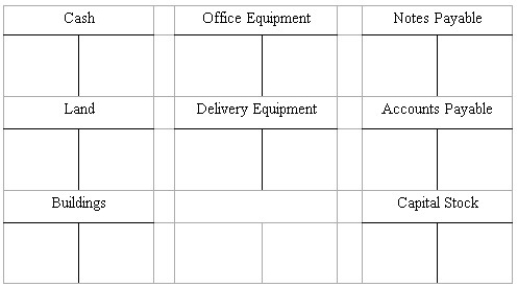

(A. )Record the above transactions directly in the T accounts below.Identify each entry in a T account with the letter shown for the transaction.This exercise does not call for the use of a journal.  (B. )Prepare a trial balance at July 31 by completing the form provided.

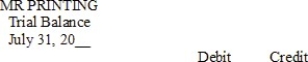

(B. )Prepare a trial balance at July 31 by completing the form provided.

Definitions:

Direct Combination Costs

Expenses directly incurred in the process of acquiring or merging with another company, such as legal fees, consultancy fees, and administrative expenses.

Acquisition Transaction

A business deal in which one company purchases another company to expand its operations.

Accounting

The systematic process of recording, analyzing, and interpreting the financial transactions of a business.

Intangible Asset

An asset that lacks physical substance but is still identifiable and provides future economic benefit to the owner, such as patents, copyrights, and goodwill.

Q1: The journal entry to record a particular

Q13: The reason that revenue is recorded by

Q18: Which of the following accounts will be

Q34: Internal users of financial accounting information include

Q53: An adjusting entry to recognize revenue that

Q55: Paddle,Inc.purchased equipment for $14,760 on February 1,2018.The

Q61: If a company records a purchase at

Q91: A CEO or CFO associated with fraudulent

Q114: Steps in the accounting cycle include (1)prepare

Q139: The need for familiarity with accounting concepts