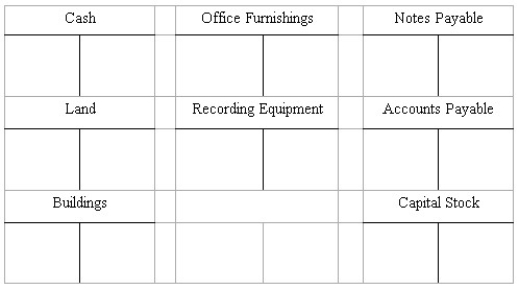

Recording transactions in T accounts;trial balance

On May 15,George Manny began a new business,called Sounds,Inc. ,a recording studio to be rented out to artists on an hourly or daily basis.The following six transactions were completed by the business during May:

(a. )Issued to Manny 5,000 shares of capital stock in exchange for his investment of $200,000 cash.

(b. )Purchased land and a building for $410,000,paying $100,000 cash and signing a note payable for the balance.The land was considered to be worth $310,000 and the building $100,000.

(c. )Installed special insulation and soundproofing throughout most of the building at a cost of $120,000.Paid $32,000 cash and agreed to pay the balance in 60 days.Manny considers these items to be additional costs of the building.

(d. )Purchased office furnishings costing $18,000 and recording equipment costing $88,400 from Music Supplies.Sounds paid $28,000 cash with the balance due in 30 days.

(e. )Borrowed $180,000 from a bank by signing a note payable.

(f. )Paid the full amount of the liability to Music Supplies arising from the purchases in D above.

Instructions

(A. )Record the above transactions directly in the T accounts below.Identify each entry in a T account with the letter shown for the transaction.This exercise does not call for the use of a journal.  (B. )Prepare a trial balance at May 31 by completing the form provided.

(B. )Prepare a trial balance at May 31 by completing the form provided.

SOUNDS,INC.

Trial Balance

May 31,20__

Debit Credit

Definitions:

Residual Income

The net income an investment or business venture generates above the minimum rate of return.

Minimum Required Rate

The lowest return rate that an investor or project manager would accept for an investment.

Residual Income

Income that remains after all costs and expenses, including minimum required return on investment, have been subtracted.

Operating Assets

Long-term assets used in the operations of a business, including property, plant, and equipment, that generate income.

Q2: Investors and creditors are interested in the

Q5: The net income of a sole proprietorship

Q8: If an asset was purchased on January

Q20: At the end of the current year,the

Q22: The period of time over which the

Q31: Before making month-end adjustments,net income of Bobwhite

Q42: Hahn Corp.has three employees.Each earns $600 per

Q49: The obligation for deferred income taxes is

Q108: The terms "sales discount," "purchase discount," and

Q141: The principle factor(s)affecting the quality of working