Accounting terminology

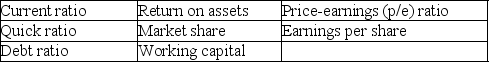

Listed below are eight technical accounting terms introduced in this chapter:

Each of the following statements may (or may not)describe one of these technical terms.For each statement,indicate the term described,or answer "None" if the statement does not correctly describe any of the terms.

Each of the following statements may (or may not)describe one of these technical terms.For each statement,indicate the term described,or answer "None" if the statement does not correctly describe any of the terms.

________ (a)The percentage of total assets financed by creditors.

________ (b)A measure of the effectiveness with which management utilizes a company's resources,regardless of how those resources are financed.

________ (c)A company's percentage share of total dollar sales within its industry.

________ (d)Current assets less current liabilities.

________ (e)A measure reflecting investors' expectations of future profitability.

________ (f)A measure of short-term solvency often used when a company has large inventories that cannot be quickly converted into cash.

________ (g)A ratio that helps individual stockholders relate the net income of a large corporation to their equity investment.

Definitions:

Salvage Value

The estimated value remaining in an asset after it has served its purpose.

Depreciation Expense

The systematic allocation of the cost of a tangible asset over its useful life, reflecting its consumption, wear and tear, or obsolescence.

Useful Life

The estimated time period that an asset is expected to be usable, contributing to the revenue-generating activities of a business.

Straight-Line Method

The straight-line method is a depreciation technique that allocates an even portion of an asset's cost to each year of the asset's useful life.

Q14: Replacing old office equipment at an immediate

Q39: Assets need not always have physical characteristics

Q58: The gross profit rate is gross profit

Q60: Calculate the amount of money that must

Q60: Dell Canada advertises a computer bundle including

Q65: Tom receives pension payments of $6000.00 at

Q88: A $100 000 bond,redeemable at 110 in

Q101: Namekagon Corporation's return on common stockholders' equity

Q130: What is the principal invested at 8%

Q142: $6420.00 was invested at a fixed rate