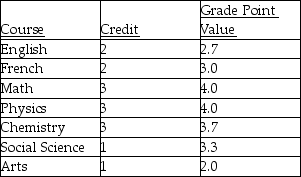

In the first term,Sam's courses and grades were as follows:

Calculate Sam's Grade Point Average (GPA).

Calculate Sam's Grade Point Average (GPA).

Definitions:

Progressive Tax System

A taxation system where the tax rate increases as the taxable amount or income increases, meaning higher-income individuals pay a larger percentage of their income in taxes than lower-income individuals.

Net Taxes

The difference between the total taxes paid to government entities and any transfers or subsidies received, representing the actual tax burden.

Transfer Payments

Payments made by the government to individuals without any expectation of goods or services in return.

Q17: When we use the AFN equation to

Q33: Simplify: 2(a - 1)(7a - 3)- 3(6a

Q38: Alicia Helm of Wawanesa,Manitoba,bought a ring for

Q40: Suppose a foreign investor who holds tax-exempt

Q59: A sales representative's orders for July were

Q61: Whittington Inc.has the following data.What is the

Q64: Different borrowers have different risks of bankruptcy,and

Q74: Solve and find the value of x,given:

Q77: Royal Collection Agency retains a collection fee

Q142: Solve: x : <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4211/.jpg" alt="Solve: x