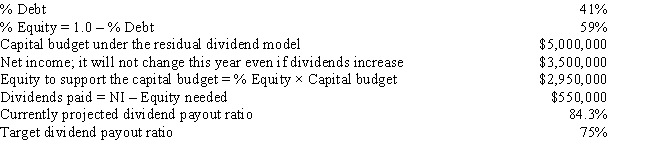

Walter Industries is a family owned concern.It has been using the residual dividend model,but family members who hold a majority of the stock want more cash dividends,even if that means a slower future growth rate.Neither the net income nor the capital structure will change during the coming year as a result of a dividend policy change to the indicated target payout ratio.By how much would the capital budget have to be cut to enable the firm to achieve the new target dividend payout ratio?

Definitions:

Management Reports

Comprehensive analyses and summaries of financial and operational data, prepared for internal management use.

Inventory Reports

Detailed documents that track the quantity, location, and status of inventory items within a business, aiding in inventory management and control.

Audit Log

A chronological documentation that captures the detailed activities or changes within an application or system for review and compliance monitoring.

Financial Statements

Collective records of a company's financial activities, including the balance sheet, income statement, statement of cash flows, and statement of changes in equity, providing insights into its financial condition and operations.

Q7: Because of improvements in forecasting techniques,estimating the

Q10: Assume that the State of Florida sold

Q16: Last year Godinho Corp.had $420 million of

Q23: The IRR method is based on the

Q33: If one of your firm's customers is

Q35: Two people living in different communities build

Q36: September is paid on a weekly commission

Q48: If one U.S.dollar sells for 0.53 British

Q58: Your company plans to produce a new

Q74: Which of the following actions will best