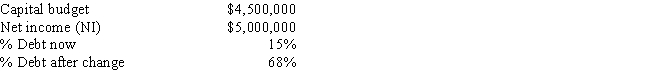

Clark Farms Inc.has the following data,and it follows the residual dividend model.Currently,it finances with 15% debt.Some Clark family members would like for the dividends to be increased.If Clark increased its debt ratio,which the firm's treasurer thinks is feasible,by how much could the dividend be increased,holding other things constant?

Definitions:

Budgets

Financial plans that forecast future income, expenditure, and resource allocation, guiding organizational decision-making.

Overhead Volume Variance

A measure used in cost accounting to analyze the difference between the budgeted and actual volume of activity, influencing the fixed manufacturing overhead.

Standard Hours

The set number of hours that are expected to be worked, often used in manufacturing to estimate labor costs.

Selling Prices

The amounts at which goods or services are sold to customers, determined by factors like cost, market demand, and competition.

Q5: Howton & Howton Worldwide (HHW)is planning its

Q15: Stock X has the following data.Assuming the

Q23: The fact that long-term debt and common

Q39: If expectations for long-term inflation rose,but the

Q43: The expected return on Natter Corporation's stock

Q51: R.J.earns $11.70 an hour,with time-and-a-half for hours

Q73: Risk-averse investors require higher rates of return

Q77: Four of the following statements are truly

Q78: Gupta Corporation is undergoing a restructuring,and its

Q93: Florence Lamb is paid a commission of