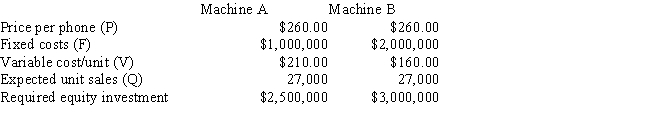

Your company,which is financed entirely with common equity,plans to manufacture a new product,a cell phone that can be worn like a wristwatch.Two robotic machines are available to make the phone,Machine A and Machine B.The price per phone will be $260.00 regardless of which machine is used to make it.The fixed and variable costs associated with the two machines are shown below,along with the capital (all equity) that must be invested to purchase each machine.The expected sales level is 27,000 units.Your company has tax loss carry-forwards that will cause its tax rate to be zero for the life of the project,so T = 0.How much higher or lower will the project's ROE be if you select the machine that produces the higher ROE,i.e. ,what is ROEB - ROEA? (Hint: Since the firm uses no debt and its tax rate is zero,ROE = EBIT/Required investment. )

Definitions:

Labour Market

The supply and demand dynamics of the workforce, where employment and wage rates are determined.

Discriminative Action

Actions or behaviors that unfairly treat or favor individuals or groups over others based on biases or prejudices.

Bona Fide

A genuine, authentic condition or quality without intent of deceit.

Strategic Assets

Valuable resources owned by a company that are instrumental in maintaining its competitive edge and achieving long-term goals.

Q9: The cost of debt is equal to

Q10: Currently,a U.S.trader notes that in the 6-month

Q11: LIBOR is an acronym for London Interbank

Q36: September is paid on a weekly commission

Q46: In Japan,90-day securities have a 4% annualized

Q52: You have been assigned the task of

Q66: The distributions of rates of return for

Q86: Projects A and B have identical expected

Q94: Which of the following statements is CORRECT?<br>A)

Q108: The risk-free rate is 6% and the