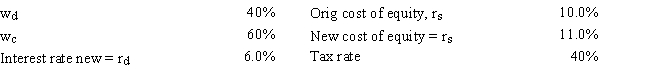

Gator Fabrics Inc.currently has zero debt .It is a zero growth company,and additional firm data are shown below.Now the company is considering using some debt,moving to the new capital structure indicated below.The money raised would be used to repurchase stock at the current price.It is estimated that the increase in risk resulting from the additional leverage would cause the required rate of return on equity to rise somewhat,as indicated below.If this plan were carried out,by how much would the WACC change,i.e. ,what is WACCOld - WACCNew? Do not round your intermediate calculations.

Definitions:

Coefficient of Correlation

A numerical metric evaluating the magnitude and orientation of a linear correlation between two variables, with values spanning from -1 to 1.

Capital Allocation Line

A graph showing risk-versus-return profiles of different portfolios, including the risk-free rate and a combination of risky assets, guiding optimal asset allocation.

Efficient Frontier

A concept in modern portfolio theory demonstrating the set of optimal portfolios offering the highest expected return for a given level of risk.

Portfolio Standard Deviation

A measure of the dispersion of the returns of a portfolio, indicating its risk.

Q10: Lasik Vision Inc.recently analyzed the project whose

Q13: Mortal Inc.expects to have a capital budget

Q22: Which of the following is NOT directly

Q22: Last year Jain Technologies had $250 million

Q47: New Orleans Builders Inc.has the following data.If

Q47: Which of the following statements is CORRECT?

Q56: Which of the following statements best describes

Q59: Bosio Inc.'s perpetual preferred stock sells for

Q75: Dalrymple Inc.is considering production of a new

Q102: Rola's Dry Cleaning shows sales revenue (exclusive