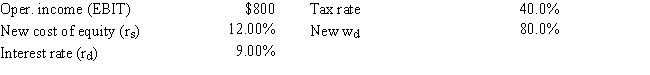

As a consultant to First Responder Inc. ,you have obtained the following data (dollars in millions) .The company plans to pay out all of its earnings as dividends,hence g = 0.Also,no net new investment in operating capital is needed because growth is zero.The CFO believes that a move from zero debt to 80.0% debt would cause the cost of equity to increase from 10.0% to 12.0%,and the interest rate on the new debt would be 9.0%.What would the firm's total market value be if it makes this change? Hints: Find the FCF,which is equal to NOPAT = EBIT(1 - T) because no new operating capital is needed,and then divide by (WACC - g) .Do not round your intermediate calculations.

Definitions:

Inequality

A mathematical statement indicating that two expressions are not equal, typically involving symbols such as > (greater than), < (less than).

Graph

A diagram representing a system of connections or interrelations among two or more things by a number of distinctive dots, lines, bars, etc.

Inequality

A mathematical statement indicating that two expressions are not equal, using symbols such as >, <, ≥, or ≤.

Solution

The result of solving a problem or equation, providing a value or set of values that satisfy the conditions expressed.

Q8: Other things held constant,an increase in the

Q32: Sub-Prime Loan Company is thinking of opening

Q32: Susmel Inc.is considering a project that has

Q48: Which of the following statements is CORRECT?<br>A)

Q65: Opportunity costs include those cash inflows that

Q83: A firm's capital structure does not affect

Q87: You have the following data on three

Q108: Cass & Company has the following data.What

Q109: Carla is paid a semi-monthly salary of

Q115: Assume that you hold a well-diversified portfolio