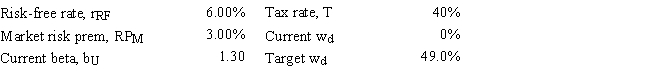

Dye Industries currently uses no debt,but its new CFO is considering changing the capital structure to 49.0% debt (wd) by issuing bonds and using the proceeds to repurchase and retire some common shares so the percentage of common equity in the capital structure (wc) = 1 - wd.Given the data shown below,by how much would this recapitalization change the firm's cost of equity,i.e. ,what is rL - rU? Do not round your intermediate calculations.

Definitions:

Competitive Market Economy

An economic system where supply and demand determine the prices of goods and services, with minimal government intervention.

Economically Most Efficient

The state of achieving the highest level of output with the lowest possible input, optimizing the use of resources without waste.

Resource Prices

The cost of inputs used in the production of goods and services, such as labor, raw materials, and capital.

Market System

An economic system relying on market forces to allocate resources and to determine and regulate prices for goods and services.

Q6: Stock A has a beta of 1.2

Q23: Which one of the following would NOT

Q27: Which of the following is NOT one

Q38: For a portfolio of 40 randomly selected

Q45: Desai Inc.has the following data,in thousands.Assuming a

Q52: Bolster Foods' (BF)balance sheet shows a total

Q54: Warnock Inc.is considering a project that has

Q63: Because money has time value,a cash sale

Q70: In general,firms should use their weighted average

Q98: Which of the following statements is CORRECT?<br>A)