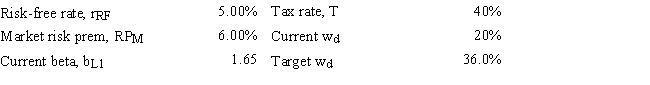

Dyson Inc.currently finances with 20.0% debt (i.e. ,wd = 20%) ,but its new CFO is considering changing the capital structure so wd = 36.0% by issuing additional bonds and using the proceeds to repurchase and retire common shares so the percentage of common equity in the capital structure (wc) = 1 - wd.Given the data shown below,by how much would this recapitalization change the firm's cost of equity? Do not round your intermediate calculations.(Hint: You must unlever the current beta and then use the unlevered beta to solve the problem. )

Definitions:

Maturity

The point in time when a financial instrument, such as a bond or loan, reaches its due date and the principal must be repaid.

Bond

A fixed income investment in which an investor loans money to an entity that borrows the funds for a defined period at a variable or fixed interest rate.

Characteristics Of A Bond

Aspects that define a bond, including its maturity date, face value, coupon rate, and issuer, determining its suitability for investors.

Interest Rate

The cost incurred, calculated as a fraction of the principal, for utilizing assets, charged by the lender to the borrower.

Q1: If on January 3 a company declares

Q3: At the beginning of the year,you purchased

Q13: Blenman Corporation,based in the United States,arranged a

Q16: Alvarez Technologies has sales of $3,000,000.The company's

Q21: Projects S and L both have an

Q29: Which of the following statements is CORRECT?<br>A)

Q31: Which of the following statements is CORRECT?<br>A)

Q39: Changes in net operating working capital should

Q40: Which of the following statements about dividend

Q60: Which of the following statements is CORRECT?<br>A)