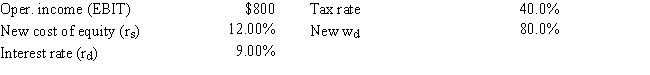

As a consultant to First Responder Inc. ,you have obtained the following data (dollars in millions) .The company plans to pay out all of its earnings as dividends,hence g = 0.Also,no net new investment in operating capital is needed because growth is zero.The CFO believes that a move from zero debt to 80.0% debt would cause the cost of equity to increase from 10.0% to 12.0%,and the interest rate on the new debt would be 9.0%.What would the firm's total market value be if it makes this change? Hints: Find the FCF,which is equal to NOPAT = EBIT(1 - T) because no new operating capital is needed,and then divide by (WACC - g) .Do not round your intermediate calculations.

Definitions:

Looseness

The state or condition of being not tightly fixed or securely attached, leading to undesired movement.

Tolerance Zone

The acceptable range of deviation from a specified dimension that a part can exhibit and still meet the necessary specifications.

Metric Fits

The standard for sizes and tolerances in metric system used to determine suitable fits between mating components.

Internal Dimensions

Measurements within an object or space, referring to the inner limits or sizes of a cavity or enclosure.

Q2: Today in the spot market $1 =

Q39: Van Den Borsh Corp.has annual sales of

Q49: Which of the following statements is CORRECT?<br>A)

Q51: Which of the following statements is CORRECT?<br>A)

Q59: You plan to invest in one of

Q66: You were hired as a consultant to

Q78: A firm's peak borrowing needs will probably

Q85: Based on the corporate valuation model,Gray Entertainment's

Q103: Your firm's cost of goods sold (COGS)average

Q108: The risk-free rate is 6% and the