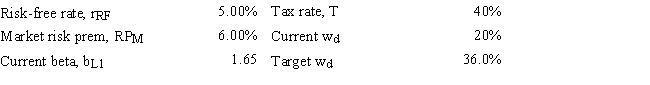

Dyson Inc.currently finances with 20.0% debt (i.e. ,wd = 20%) ,but its new CFO is considering changing the capital structure so wd = 36.0% by issuing additional bonds and using the proceeds to repurchase and retire common shares so the percentage of common equity in the capital structure (wc) = 1 - wd.Given the data shown below,by how much would this recapitalization change the firm's cost of equity? Do not round your intermediate calculations.(Hint: You must unlever the current beta and then use the unlevered beta to solve the problem. )

Definitions:

Subsidiaries

Companies that are owned or controlled by another company, known as the parent company, through a majority of the voting stock.

Domestic Firm

A company that operates primarily within the borders of its home country and is subject to its home country's jurisdiction and regulations.

Ownership Interest

Indicates an individual's or entity's legal rights and stakes in a company or property.

Consolidated Stockholders' Equity

The total equity in a conglomerate of all the shareholders combined, as if the conglomerate and its subsidiaries were a single entity.

Q16: A 100% stock dividend and a 2:1

Q26: Which of the following statements is CORRECT?<br>A)

Q31: Which of the following statements is CORRECT?<br>A)

Q41: Which of the following statements is CORRECT?<br>A)

Q47: If one U.S.dollar buys 0.61 euro,how many

Q65: Stock A has an expected return of

Q73: Nachman Industries just paid a dividend of

Q84: Gray Manufacturing is expected to pay a

Q94: Which of the following statements is CORRECT?<br>A)

Q98: Which of the following statements is CORRECT?<br>A)