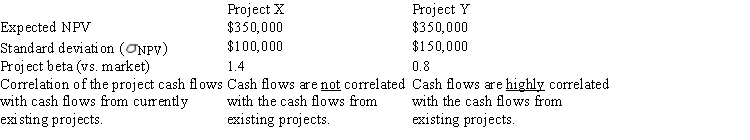

Taussig Technologies is considering two potential projects,X and Y.In assessing the projects' risks,the company estimated the beta of each project versus both the company's other assets and the stock market,and it also conducted thorough scenario and simulation analyses.This research produced the following data: Project X

Project Y

Expected NPV

$350,000

$350,000

Standard deviation (  NPV)

NPV)  $100,000

$100,000

$150,000

Project beta (vs.market)

1) 4

0) 8

Correlation of the project cash flows with cash flows from currently existing projects.

Cash flows are not correlated with the cash flows from existing projects.

Cash flows are highly correlated with the cash flows from existing projects.

Which of the following statements is CORRECT?

Definitions:

Unconditional Response

A natural, unlearned reaction to a stimulus in classical conditioning, such as salivating when smelling food.

Loud Noise

Intense auditory stimuli that can potentially harm hearing and cause psychological stress.

Fire

A rapid oxidation process, which is a chemical reaction resulting in the release of heat and light.

Sealskin Coat

A type of outer garment made from the skin of seals, traditionally used for its warmth and waterproof qualities.

Q1: Taxes due to federal and state governments.<br>A)

Q2: If you receive $15,000 today and can

Q8: As the text indicates,a firm's financial risk

Q9: The use of accelerated versus straight-line depreciation

Q16: McCall Manufacturing has a WACC of 10%.The

Q20: The term "spontaneously generated funds" generally refers

Q21: A share of common stock just paid

Q43: Which of the following events is likely

Q48: If one U.S.dollar sells for 0.53 British

Q97: Which of the following statements is CORRECT?<br>A)