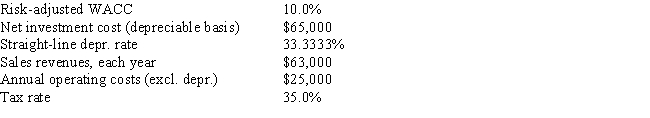

Temple Corp.is considering a new project whose data are shown below.The equipment that would be used has a 3-year tax life,would be depreciated by the straight-line method over its 3-year life,and would have a zero salvage value.No change in net operating working capital would be required.Revenues and other operating costs are expected to be constant over the project's 3-year life.What is the project's NPV? Do not round the intermediate calculations and round the final answer to the nearest whole number.

Definitions:

Put Option

A financial contract giving the owner the right, but not the obligation, to sell a specified amount of an underlying security at a specified price within a specified time.

Stock Price

The cost of purchasing a share of a company, as traded on a stock exchange, which may fluctuate based on supply and demand dynamics.

Exercise Price

The price at which the holder of an option can buy (in the case of a call option) or sell (in the case of a put option) the underlying asset.

Stock Volatility

The rate at which the price of a stock increases or decreases for a given set of returns, indicative of the risk or stability.

Q1: A basic rule in capital budgeting is

Q6: To help finance a major expansion,Castro Chemical

Q7: Goode Inc.'s stock has a required rate

Q27: Schnusenberg Corporation just paid a dividend of

Q32: Susmel Inc.is considering a project that has

Q34: Which of the following statements is CORRECT?<br>A)

Q37: A major contribution of the Miller model

Q67: Dye Industries currently uses no debt,but its

Q92: Harry's Inc.is considering a project that has

Q133: One key conclusion of the Capital Asset