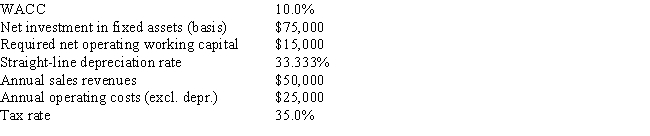

Foley Systems is considering a new investment whose data are shown below.The equipment would be depreciated on a straight-line basis over the project's 3-year life,would have a zero salvage value,and would require additional net operating working capital that would be recovered at the end of the project's life.Revenues and other operating costs are expected to be constant over the project's life.What is the project's NPV? (Hint: Cash flows from operations are constant in Years 1 to 3. ) Do not round the intermediate calculations and round the final answer to the nearest whole number.

Definitions:

Q5: The Miller model begins with the Modigliani

Q5: Whitmer Inc.sells to customers all over the

Q6: Refer to Exhibit 7A.1.What is the nominal

Q16: Which of the following is NOT directly

Q46: The text identifies three methods for estimating

Q63: Jim Angel holds a $200,000 portfolio consisting

Q73: Projects S and L both have normal

Q81: Refer to Exhibit 10.1.What is the best

Q97: Barry Company is considering a project that

Q138: Which of the following statements is CORRECT?<br>A)