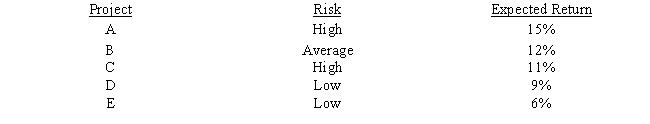

Langston Labs has an overall (composite) WACC of 10%,which reflects the cost of capital for its average asset.Its assets vary widely in risk,and Langston evaluates low-risk projects with a WACC of 8%,average-risk projects at 10%,and high-risk projects at 12%.The company is considering the following projects:

Which set of projects would maximize shareholder wealth?

Definitions:

Grade Equivalent

A measure indicating the school grade level of students to whom a test taker's performance is most similar.

Achievement Test

A type of ability test that measures what one has learned. Types of achievement tests include survey battery tests, diagnostic tests, and readiness tests.

Percentiles

A measure that indicates the value below which a given percentage of observations in a group of observations falls.

Stanines

Derived from the term “standard nines,” this is a standardized score frequently used in schools. Often used with achievement tests, stanines have a mean of 5 and a standard deviation of 2, and range from 1 to 9.

Q1: You work for the CEO of a

Q5: Which of the following statements is CORRECT?

Q24: A conflict will exist between the NPV

Q28: Provided a firm does not use an

Q36: Modigliani and Miller's first article led to

Q54: Walter Industries is a family owned concern.It

Q72: Under certain conditions,a project may have more

Q76: Projected free cash flows should be discounted

Q87: Changes in a firm's collection policy can

Q94: The component costs of capital are market-determined