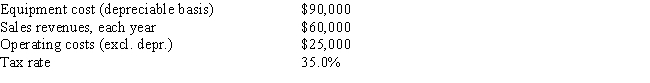

Fool Proof Software is considering a new project whose data are shown below.The equipment that would be used has a 3-year tax life,and the allowed depreciation rates for such property are 33%,45%,15%,and 7% for Years 1 through 4.Revenues and other operating costs are expected to be constant over the project's 10-year expected life.What is the Year 1 cash flow?

Definitions:

Q6: Suppose 144 yen could be purchased in

Q9: Sheehan Corp.is forecasting an EPS of $5.00

Q28: Suppose the credit terms offered to your

Q31: Whited Products recently completed a 4-for-1 stock

Q36: When considering the risk of a foreign

Q39: Myron Gordon and John Lintner believe that

Q68: The risk to the firm of borrowing

Q74: The change in net operating working capital

Q80: Ingram Office Supplies,Inc. ,buys on terms of

Q111: A firm constructing a new manufacturing plant