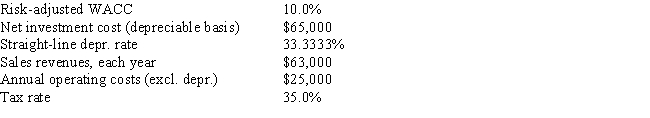

Temple Corp.is considering a new project whose data are shown below.The equipment that would be used has a 3-year tax life,would be depreciated by the straight-line method over its 3-year life,and would have a zero salvage value.No change in net operating working capital would be required.Revenues and other operating costs are expected to be constant over the project's 3-year life.What is the project's NPV? Do not round the intermediate calculations and round the final answer to the nearest whole number.

Definitions:

Depreciating Assets

Assets that lose value over time due to use, wear and tear, or obsolescence, such as machinery, vehicles, and buildings.

Accumulated Depreciation

The total amount of depreciation expense that has been recorded for an asset since it was put into use, reducing its book value on the balance sheet.

Historical Cost

The original monetary value of an asset or investment, as recorded on the financial statements at the time of purchase or acquisition.

Q5: Which of the following statements is CORRECT?

Q10: Last year Handorf-Zhu Inc.had $850 million of

Q14: Stocks A and B each have an

Q16: Which of the following is NOT directly

Q29: Which of the following statements is CORRECT?<br>A)

Q58: Which of the following rules is CORRECT

Q75: Your boss,Sally Maloney,treasurer of Fred Clark Enterprises

Q84: Your girlfriend plans to start a new

Q97: Barry Company is considering a project that

Q105: Porter Inc's stock has an expected return