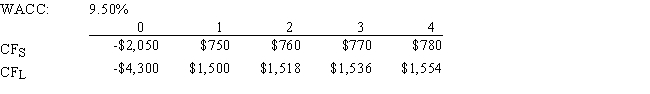

Sexton Inc.is considering Projects S and L,whose cash flows are shown below.These projects are mutually exclusive,equally risky,and not repeatable.If the decision is made by choosing the project with the higher IRR,how much value will be forgone? Note that under certain conditions choosing projects on the basis of the IRR will not cause any value to be lost because the one with the higher IRR will also have the higher NPV,so no value will be lost if the IRR method is used.

Definitions:

Lump Sum

A single payment made at a particular time, as opposed to a series of smaller payments or installments.

Interest Rates

The proportion of a loan that is charged as interest to the borrower, typically expressed as an annual percentage of the loan outstanding.

Ordinary Annuity

A series of equal payments made at regular intervals, with interest compounded at the end of each period.

Q11: The real risk-free rate is 3.05%,inflation is

Q13: Warr Company is considering a project that

Q25: Assuming all else is constant,which of the

Q27: Eakins Inc.'s common stock currently sells for

Q55: Which of the following statements is CORRECT?

Q72: Southwest U's campus book store sells course

Q76: Business risk is affected by a firm's

Q81: Kern Corporation's 5-year bonds yield 7.50% and

Q81: Carter's preferred stock pays a dividend of

Q93: Shorter-term cash budgets (such as a daily