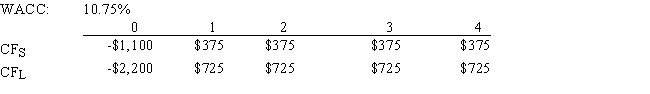

Nast Inc.is considering Projects S and L,whose cash flows are shown below.These projects are mutually exclusive,equally risky,and not repeatable.If the decision is made by choosing the project with the higher MIRR rather than the one with the higher NPV,how much value will be forgone? Note that under some conditions choosing projects on the basis of the MIRR will cause $0.00 value to be lost.

Definitions:

Discrimination

Unfair treatment of individuals based on their membership in a particular group, such as race, gender, or sexual orientation.

Classical Conditioning

An educational method where associations between a naturally occurring stimulus and an environmental stimulus take place.

Operant Conditioning

A method of learning that occurs through rewards and punishments for behavior.

Spontaneous Recovery

The reappearance of a response (conditioned response) that had been extinguished after some time has passed without exposure to the conditioned stimulus.

Q6: Because the maturity risk premium is normally

Q8: A proxy is a document giving one

Q15: Which of the following would be most

Q28: Which of the following procedures does the

Q29: Misra Inc.forecasts a free cash flow of

Q35: Estimating project cash flows is generally the

Q56: McCue Inc.'s bonds currently sell for $1,175.They

Q59: Other things held constant,which of the following

Q67: The preemptive right gives current stockholders the

Q74: Which of the following statements is CORRECT?<br>A)