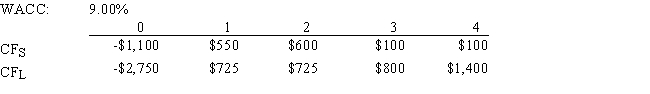

Noe Drilling Inc.is considering Projects S and L,whose cash flows are shown below.These projects are mutually exclusive,equally risky,and not repeatable.The CEO believes the IRR is the best selection criterion,while the CFO advocates the MIRR.If the decision is made by choosing the project with the higher IRR rather than the one with the higher MIRR,how much,if any,value will be forgone,i.e. ,what's the NPV of the chosen project versus the maximum possible NPV? Note that (1) "true value" is measured by NPV,and (2) under some conditions the choice of IRR vs.MIRR will have no effect on the value lost.

Definitions:

Current Value

The present worth of an asset or company based on market conditions, differing from historical costs or book value.

End of the First Year

The completion of the first 12-month period of an event or operation, typically used in financial contexts.

Risk Premium

The additional return expected by an investor for holding a risky asset over a risk-free one, compensating for the higher risk.

Equity Investing

The act of purchasing shares of stock in companies with the expectation of earning dividends or selling the shares at a higher price in the future.

Q10: If a firm utilizes debt financing,a 10%

Q28: Preferred stock is a hybrid--a sort of

Q30: Two firms with identical capital intensity ratios

Q30: If a firm's projects differ in risk,then

Q35: Francis Inc.'s stock has a required rate

Q48: Which of the following statements is CORRECT?<br>A)

Q53: Which of the following events would make

Q71: If an investment project would make use

Q86: Jill Angel holds a $200,000 portfolio consisting

Q92: The CAPM is a multi-period model that