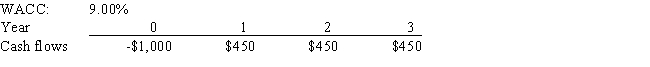

Ehrmann Data Systems is considering a project that has the following cash flow and WACC data.What is the project's MIRR? Note that a project's projected MIRR can be less than the WACC (and even negative) ,in which case it will be rejected.

Definitions:

Q2: Rowell Company spent $3 million two years

Q15: Margetis Inc.carries an average inventory of $750,000.Its

Q25: The NPV and IRR methods,when used to

Q28: Suppose the credit terms offered to your

Q46: Typically,a project will have a higher NPV

Q48: Whitman Antique Cars Inc.has the following data,and

Q56: Other things held constant,which of the following

Q67: The preemptive right gives current stockholders the

Q77: During periods when inflation is increasing,interest rates

Q97: Barry Company is considering a project that