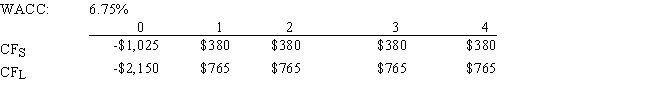

A firm is considering Projects S and L,whose cash flows are shown below.These projects are mutually exclusive,equally risky,and not repeatable.The CEO wants to use the IRR criterion,while the CFO favors the NPV method.You were hired to advise the firm on the best procedure.If the wrong decision criterion is used,how much potential value would the firm lose?

Definitions:

Empirical

Empirical refers to information acquired by observation or experimentation, basing knowledge on empirical evidence is foundational in science.

Sociohistorical Context

Sociohistorical context refers to how societal and historical factors influence and shape behaviors, events, and perceptions.

Classical Conditioning

Gaining knowledge through the connections made between an environmental cue and a stimulus that naturally exists.

Operant Conditioning

A method of learning that uses rewards and punishments to increase or decrease the likelihood of a behavior.

Q3: Vang Enterprises,which is debt-free and finances only

Q8: If management wants to maximize its stock

Q22: Which of the following statements is CORRECT?<br>A)

Q24: Since the focus of capital budgeting is

Q31: If a firm wants to maintain its

Q36: You observe the following information regarding Companies

Q52: Which of the following statements is CORRECT?<br>A)

Q54: Walter Industries is a family owned concern.It

Q59: Purcell Farms Inc.has the following data,and it

Q78: Suppose you are the president of a