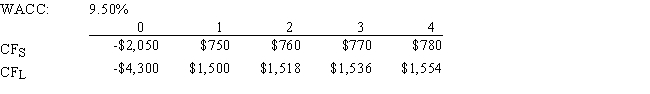

Sexton Inc.is considering Projects S and L,whose cash flows are shown below.These projects are mutually exclusive,equally risky,and not repeatable.If the decision is made by choosing the project with the higher IRR,how much value will be forgone? Note that under certain conditions choosing projects on the basis of the IRR will not cause any value to be lost because the one with the higher IRR will also have the higher NPV,so no value will be lost if the IRR method is used.

Definitions:

Perceptual Selection

The process by which individuals filter and selectively focus on certain stimuli in the environment while ignoring others, based on personal interests, background, and psychological factors.

Expatriate Failure

The situation when an expatriate, or an individual working outside their native country, is unable to adapt to the foreign environment, leading to poor performance or early return.

Technical Competence

The ability and skills a person possesses to perform a specific technical task or job.

Implicit Personality Effect

The phenomenon where observers form perceptions of others' personalities based on minimal information, often leading to biased judgments.

Q6: To help finance a major expansion,Castro Chemical

Q16: A 100% stock dividend and a 2:1

Q23: Which one of the following would NOT

Q53: Other things held constant,the lower a firm's

Q56: McCue Inc.'s bonds currently sell for $1,175.They

Q65: You are considering 2 bonds that will

Q84: When estimating the cost of equity by

Q86: Which of the following statements is CORRECT?<br>A)

Q92: One of the effects of ceasing to

Q109: Under the CAPM,the required rate of return