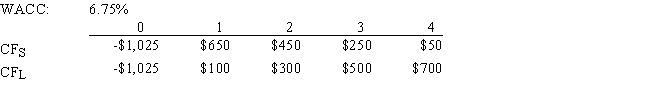

Moerdyk & Co.is considering Projects S and L,whose cash flows are shown below.These projects are mutually exclusive,equally risky,and not repeatable.If the decision is made by choosing the project with the higher IRR,how much value will be forgone? Note that under certain conditions choosing projects on the basis of the IRR will not cause any value to be lost because the one with the higher IRR will also have the higher NPV,i.e. ,no conflict will exist.

Definitions:

Short Hedging

An investment strategy used to offset potential losses in one position by taking an opposite position in a related asset.

Hog Farmer

An individual or business involved in raising and breeding pigs for meat production, a key player in the agriculture sector.

Hog Futures

Financial contracts that obligate the buyer to purchase, and the seller to sell, a specific quantity of hogs at a predetermined price at a future date.

Limit Risk

Strategies or mechanisms implemented to reduce the potential for financial loss in investments.

Q9: Net operating working capital,defined as current assets

Q13: Stock A has a beta of 0.8,Stock

Q16: Assume that the risk-free rate is 6%

Q27: Which of the following is NOT one

Q45: Assume the following: The real risk-free rate,r*,is

Q53: If a firm's stockholders are given the

Q56: Which of the following statements best describes

Q59: Other things held constant,which of the following

Q66: Which of the following statements is CORRECT?<br>A)

Q80: Stocks A and B have the following