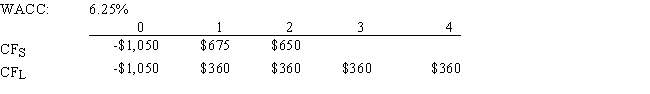

Kosovski Company is considering Projects S and L,whose cash flows are shown below.These projects are mutually exclusive,equally risky,and are not repeatable.If the decision is made by choosing the project with the higher IRR,how much value will be forgone? Note that under some conditions choosing projects on the basis of the IRR will cause $0.00 value to be lost.

Definitions:

Null Hypothesis

A default hypothesis that assumes no significant difference or effect between groups or variables in a statistical test.

Hypothesis Testing

A method in statistics to decide whether to accept or reject a hypothesis based on sample data, to determine the likelihood that a parameter related to the population is true.

Research Hypothesis

A specific, testable prediction about the expected outcome of a study.

Probability

A measure of the likelihood that an event will occur, expressed as a number between 0 and 1.

Q10: Lasik Vision Inc.recently analyzed the project whose

Q33: Stock X has a beta of 0.5

Q35: Soenen Inc.had the following data for last

Q38: Which of the following statements is CORRECT?<br>A)

Q47: Molen Inc.has an outstanding issue of perpetual

Q62: Grullon Co.is considering a 7-for-3 stock split.The

Q65: A stock is expected to pay a

Q65: Opportunity costs include those cash inflows that

Q77: Since depreciation is a non-cash charge,it neither

Q98: Which of the following statements is CORRECT?<br>A)