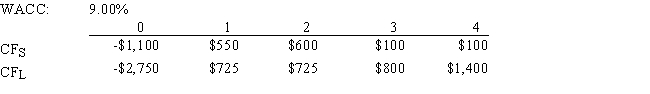

Noe Drilling Inc.is considering Projects S and L,whose cash flows are shown below.These projects are mutually exclusive,equally risky,and not repeatable.The CEO believes the IRR is the best selection criterion,while the CFO advocates the MIRR.If the decision is made by choosing the project with the higher IRR rather than the one with the higher MIRR,how much,if any,value will be forgone,i.e. ,what's the NPV of the chosen project versus the maximum possible NPV? Note that (1) "true value" is measured by NPV,and (2) under some conditions the choice of IRR vs.MIRR will have no effect on the value lost.

Definitions:

Indirect Pressure

A subtle form of influence where suggestions rather than explicit demands are used to guide behavior.

Groupthink Characteristics

Groupthink characteristics involve a group decision-making process where the desire for harmony and conformity results in an irrational or dysfunctional outcome.

Wildcat Strike

An unauthorized or illegal work stoppage initiated by employees without the sanction of their union.

Illegal Strike

A work stoppage or labor strike that is not authorized by law, often due to it not following the proper legal procedures.

Q2: Which of the following statements is CORRECT?<br>A)

Q25: Which of the following statements is CORRECT?<br>A)

Q33: Bankston Corporation forecasts that if all of

Q36: An increase in the firm's WACC will

Q69: Suppose Boyson Corporation's projected free cash flow

Q73: Nachman Industries just paid a dividend of

Q73: Fauver Industries plans to have a capital

Q77: Which of the following statements is CORRECT?<br>A)

Q78: A firm's peak borrowing needs will probably

Q101: If an investor buys enough stocks,he or