Exhibit 10.1

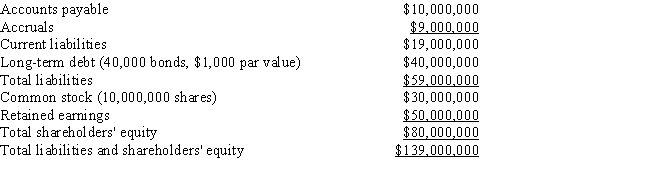

Assume that you have been hired as a consultant by CGT,a major producer of chemicals and plastics,including plastic grocery bags,styrofoam cups,and fertilizers,to estimate the firm's weighted average cost of capital.The balance sheet and some other information are provided below.

Assets  Liabilities and Equity

Liabilities and Equity  The stock is currently selling for $17.75 per share,and its noncallable $3,319.97 par value,20-year,1.70% bonds with semiannual payments are selling for $881.00.The beta is 1.29,the yield on a 6-month Treasury bill is 3.50%,and the yield on a 20-year Treasury bond is 5.50%.The required return on the stock market is 11.50%,but the market has had an average annual return of 14.50% during the past 5 years.The firm's tax rate is 40%.

The stock is currently selling for $17.75 per share,and its noncallable $3,319.97 par value,20-year,1.70% bonds with semiannual payments are selling for $881.00.The beta is 1.29,the yield on a 6-month Treasury bill is 3.50%,and the yield on a 20-year Treasury bond is 5.50%.The required return on the stock market is 11.50%,but the market has had an average annual return of 14.50% during the past 5 years.The firm's tax rate is 40%.

-Refer to Exhibit 10.1.Which of the following is the best estimate for the weight of debt for use in calculating the WACC?

Definitions:

Thorndike

Edward Thorndike was an American psychologist known for his work on the law of effect and animal learning through trial and error.

Insight

The understanding or awareness of one's own mental or emotional processes, often leading to a sudden and profound understanding of a problem or situation.

Conditioned Response

A conditioned response is an automatic response established by training to an ordinarily neutral stimulus.

Unconditioned Stimulus (UCS)

In classical conditioning, a stimulus that naturally and automatically triggers a reflexive response without prior learning.

Q12: The federal government sometimes taxes dividends and

Q16: The Isberg Company just paid a dividend

Q39: The real risk-free rate is expected to

Q46: Typically,a project will have a higher NPV

Q47: Molen Inc.has an outstanding issue of perpetual

Q56: Helena Furnishings wants to reduce its cash

Q64: The real risk-free rate is 3.55%,inflation is

Q67: Which of the following statements is CORRECT?<br>A)

Q79: Which of the following statements is NOT

Q97: Jose now has $500.How much would he