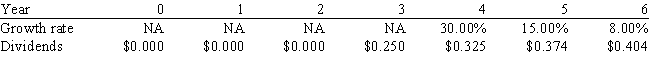

Agarwal Technologies was founded 10 years ago.It has been profitable for the last 5 years,but it has needed all of its earnings to support growth and thus has never paid a dividend.Management has indicated that it plans to pay a $0.25 dividend 3 years from today,then to increase it at a relatively rapid rate for 2 years,and then to increase it at a constant rate of 8.00% thereafter.Management's forecast of the future dividend stream,along with the forecasted growth rates,is shown below.Assuming a required return of 11.00%,what is your estimate of the stock's current value?

Definitions:

Economic Pie

A metaphorical representation of the total wealth or economic output available in a society or economy.

Cumulative Share

The total percentage of a market or segment controlled by a company or entity, accumulated over time.

Families Earned

Income generated by household members through wages, salaries, investments, or other sources.

Cumulative Share

The total portion or percentage owned or contributed by an individual or entity over time.

Q4: Suppose the real risk-free rate is 3.25%,the

Q9: Which of the following statements is CORRECT?<br>A)

Q10: A company is considering a proposed new

Q28: If 10-year T-bonds have a yield of

Q61: Dentaltech Inc.projects the following data for the

Q73: Fauver Industries plans to have a capital

Q74: Stocks A and B have the following

Q74: Last year Dania Corporation's sales were $525

Q142: Suppose you hold a portfolio consisting of

Q146: You have the following data on (1)the